KBM Training and Recruitment is a leading training provider specialising in Accounting, Finance, Taxation, Audit and Business Administration. .........

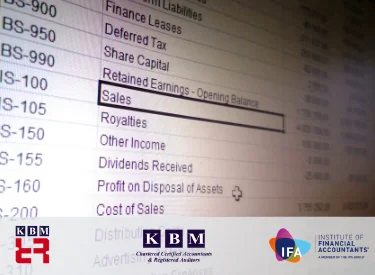

We offer flexible delivery & timetables to suit your needs delivering one-to-one hand-on training. We are committed to provide specialist knowledge and professionalism; our training programmes include extensive use of modern accounting software like Sage, QuickBooks, SAP, SAPA, SAGE Compliance, Excel, Xero and Sage One.

We are accredited by AAT, NCFE and OCR (Oxford Cambridge & RSA). We also provide non accredited training programmes from fundamental to professional skills level and have helped thousands of candidates in Training, Employment and Further Education.

We also deliver public funding projects including European Social Fund (ESF), Education & Skills Funding Agency (ESFA), Department for Education (DfE), Local Government and EU Erasmus+. The programmes include Traineeships, Apprenticeships, NEET, Adult Education Budget, Advanced Learning Loans, Erasmus+ (KA1 & KA2) and Employability programmes for Local Authorities. In addition, we provide pre-employment training & support, work placements, vocational skills & retraining, advice on an interview, CV writing, job search, etc.

We are on the ESFA RoATP (Register of Apprenticeship Training Providers) with an Outstanding Grade – UKPRN # 10045412

We are Matrix Certified for Information, Advice and Guidance (IAG) to help individuals progress into employment & develop career potential to gain the skills and qualifications they need to get jobs and further education.

Working closely with employers, we ensure that our training programmes match their business priorities. Setting clear objectives ensures our learners have a positive attitude to learning and enjoy their programmes while making good progress.